The U.S. Securities and Exchange Commission (SEC) is currently engaging in a sweeping crackdown on the “crypto” world, and as a passionate bitcoiner, I honestly couldn’t care less about it.

Let me explain.

In what some in the “crypto” world are referring to as Operation Chokepoint 2.0, the SEC appears motivated to broadly take action against “crypto” enterprises with branches in the United States, starting with the popular exchanges that allow for easy access to the endless array of tokens that are available through these businesses.

If this industry was providing any value to righteous individuals and our greater society, it would certainly be a reason for concern. But that isn’t the case whatsoever. In fact, the crypto industry exists to pick the pockets of the desperate and/or naive retail buyer to the benefit of a handful of ruthlessly deceitful, predatory venture capital fund swindlers.

A broken clock is right twice a day, as they say, and the SEC, which I obviously won’t pretend is some kind of righteous institution, is in fact doing us all a favor by wreaking havoc upon this industry. Crypto is not so much an industry as it is a scammer’s paradise, because there are no real innovations in crypto, only Potemkin villages, Rube Goldberg marketing machines, convoluted buzzwords, and other technobabble rearrangements that appear from afar as novel, but better resemble the contents of Al Capone’s vault.

The “crypto” industry made a fortune by riding the coattails of bitcoin, a truly novel and groundbreaking innovation, to pursue their scams. In the process of defrauding the public, the crypto space muddied the conversation around the amazing advancement to humanity that is bitcoin in the process, adding roadblocks to the adoption of an asset that has the potential to bolster freedom and dramatically improve quality of life worldwide.

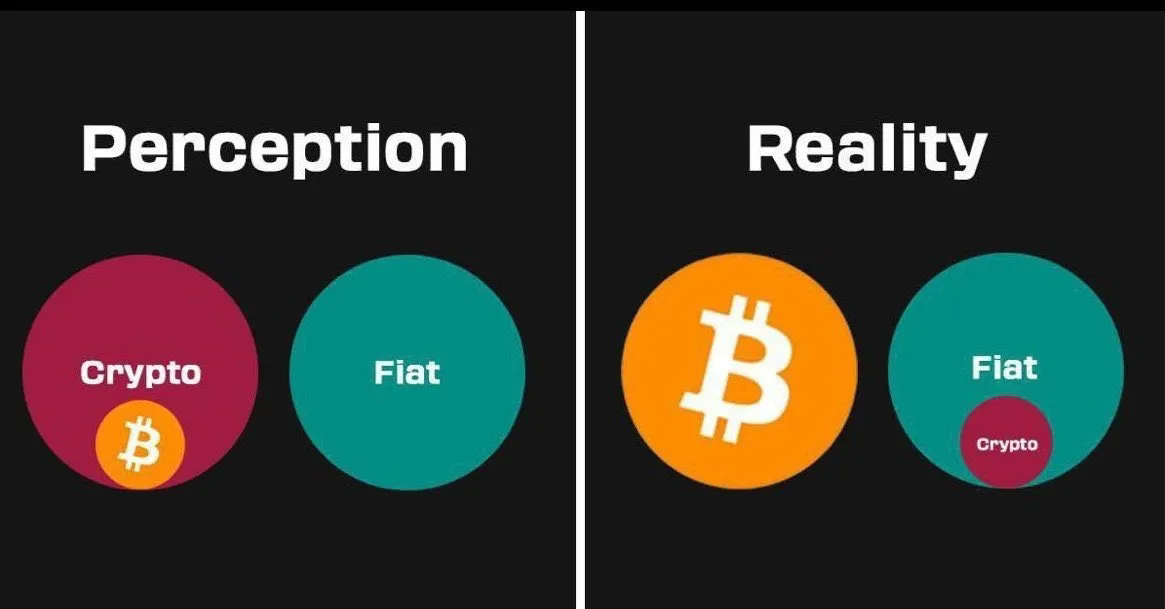

Contrary to popular belief, “crypto” assets largely do not share some or any of the properties of bitcoin. It is nothing more than the fiat system on steroids. The vast majority of crypto tokens have an incredibly centralized command structure and resemble nothing close to the monetary properties of bitcoin other than the fact that both are accessible via the internet. Sure, the SEC or other government agencies could decide to “go after” Bitcoin (even though SEC chair Gary Gensler has made it clear that Bitcoin is not a security), but Bitcoin is globally distributed and well positioned to withstand and even thrive long term from such an attack.

Binance and Coinbase, two major institutions that are currently being targeted by the SEC, indeed deserve recognition for their efforts to bring bitcoin adoption to the world. For several years, these exchanges, among others, broke new ground by facilitating a much easier and more transparent means to purchase and store bitcoin in an expedited fashion.

But then they got greedy, and proceeded to become partners to a massive racket.

These aren’t the same institutions that they were in the mid 2010s, when they only made a handful of assets available to the public.

I highly encourage you to read Swan Bitcoin (former sponsor of The Dossier) CEO Cory Klippsten’s Twitter thread about Coinbase, which describes the current business model adopted by the predominant global "crypto” exchanges.

What Coinbase and Binance, among others, have been doing for many years now, is effectively using their loyal retail customers as exit liquidity for their billionaire venture capital partners in the predatory scam coin marketing space.

A token listing on a major exchange opens up enormous liquidity for the creators of these vaporware assets. Once the scam coin manufacturers generate enough buying interest through fraudulent marketing practices and “the listing,” they proceed to sell the tokens they created, immediately abandoning the buzzword heavy “projects” they claimed would be the next big thing in “crypto.”

Now that their deceptive schemes are being noticed by regulators, many in the industry are jumping ship to “the Metaverse” and “AI.”

As former Tucker Carlson producer Gregg Re has demonstrated, these newfound AI brands are engaging in the very same unethical schemes they pursued when trying to dump their crypto tokens on retail.

Crypto has become a dirty word in the public's lexicon for the right reasons. The not so well kept secret about this space is that Sam Bankman Fried (FTX), Alex Mashinsky (Celsius), Do Kwon (Luna), and the rest of the high profile scammers in crypto land are not anomalies of their industry, but the *standard* for that industry, which has a seeming magnetic effect of accumulating the very worst of swindlers and grifters.

As a bitcoiner, I believe in the importance of the very ethical mission of separating money from state, and am well aware of the reality that the SEC is not exactly a fair arbitrator in financial regulatory disputes, to put it mildly. However, it’s not worth shedding a single tear for the “crypto” industry, because they didn’t shed a tear, but were high-fiving in smoke filled Silicon Valley rooms while using you as exit liquidity for their countless affinity scam projects.

No comments:

Post a Comment